37+ recommended mortgage to income ratio

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033.

Real Estate Market Golden Real Estate S Blog

With a Low Down Payment Option You Could Buy Your Own Home.

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

. Debt-to-income ratio total monthly debt paymentsgross monthly income. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. Web Your monthly debt payments would be as follows.

A front-end and a back-end. Web In general lenders prefer that your back-end ratio not exceed 36. Ad Calculate Your Payment with 0 Down.

Web The 2836 rule is a guide that helps mortgage lenders determine how large a mortgage you can afford. Principal interest taxes and insurance. Some financial experts recommend other percentage models like the 3545 model.

Getty Images A good debt-to-income ratio is key to loan approval whether youre seeking a mortgage. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Web TLDR Too Long.

Web The 3545 Model. Web Experts say you want to aim for a DTI of about 43 or less. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

That means if you earn 5000 in monthly gross income your total debt obligations should be. With a Low Down Payment Option You Could Buy Your Own Home. Debt can be harder to manage if your DTI ratio falls between.

Compare Offers From Our Partners To Find One For You. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

You have a pretax income of 4500 per month. A VA loan is likely the best option for high-debt borrowers. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

This rule says you. Ad Tired of Renting. Web DTI example calculation.

Keep your total debt payments at or below 40 of your pretax monthly income. Compare Offers From Our Partners To Find One For You. Web If youd put 10 down on a 555555 home your mortgage would be about 500000.

In that case NerdWallet recommends an annual pretax income of at least 184656. So with 6000 in gross monthly income your maximum amount. Didnt Read To calculate your mortgage-to-income ratio divide your total monthly housing costs by your monthly gross earnings.

Why Rent When You Could Own. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000 6000 033.

The 28 rule isnt universal. Web But you can learn how to get a loan with a high debt-to-income ratio. Its based on two calculations.

Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

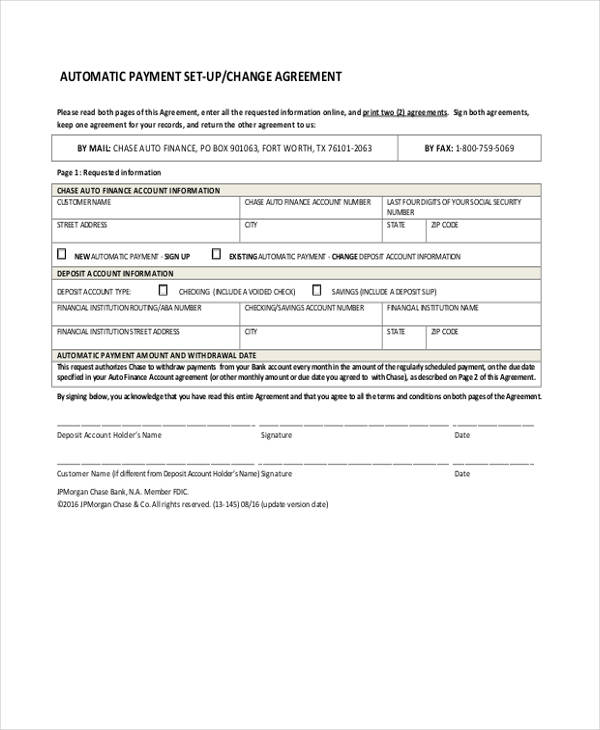

Free 37 Loan Agreement Forms In Pdf Ms Word

Calculating Your Debt To Income Ratio How To Guide

A Mind Blowing 2022 Review Of World Money Global Balance Sheet And Its 13 Global Markets

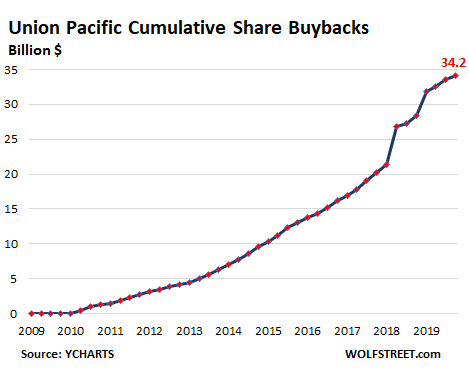

Union Pacific Cut 17 Of Its Workers Will Cut 8 In 2020 Revenue Fell 9 5 Income 10 Bought Back 5 8 Bn In Shares Stock Hits New High Wolf Street

Home Mortgage Debt To Disposable Personal Income Ratio In The Us Download Scientific Diagram

What S An Ideal Debt To Income Ratio For A Mortgage

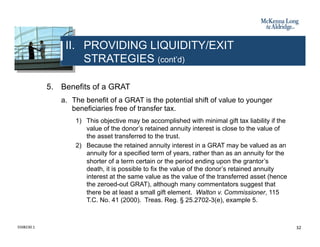

Business Succession Planning And Exit Strategies For The Closely Held

37 Credit Repair Statistics And Facts For 2022 Screen And Reveal

Why Is There A Widespread Job Dissatisfaction Among Today S Youth Quora

The Mortgage Network Golden Real Estate S Blog

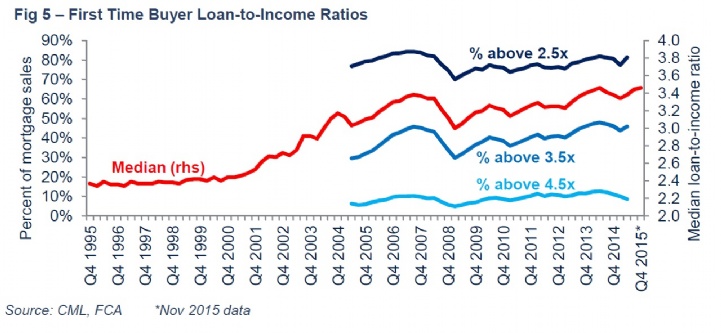

Savills Uk Household Debt

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

How Much Mortgage Can I Get For My Salary Martin Co

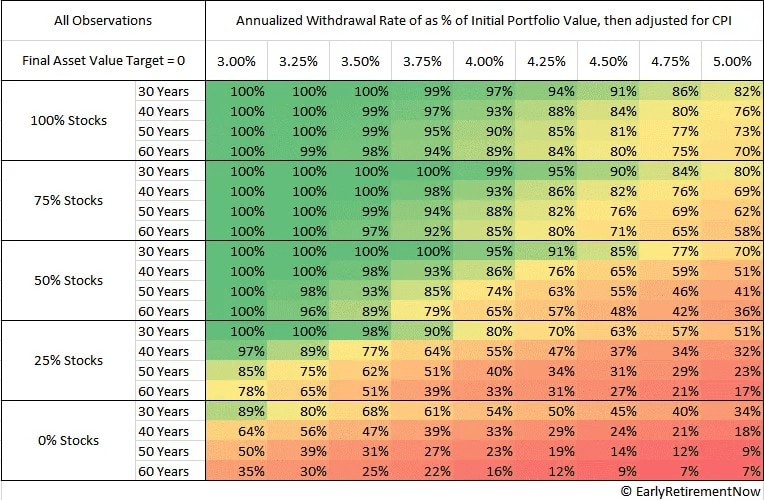

Safe Retirement Withdrawal Rate Strategies In Canada Million Dollar Journey